How To Get A Startup Business Loan With No Money

There have been many great businesses that began in garages. Apple and Amazon began as grocery stores. Samsung first produced refrigerators. Coca-Cola first produced jugs of their products and sold them at local pharmacies for a nickel a glass.

Funding your startup at the right moment is vital to getting your business off the ground and on its way to success. When the right moment arrives, securing the right funding for your startup can be vital in getting your business off the ground and on its way to success.

There are startup business loans available for people with no revenue and limited credit histories.

Alternative financing options specialize in helping entrepreneurs starting from scratch, while traditional lenders prefer businesses that are already established.

Business loans for startups with no revenue

There are several financing options available to you if you are just starting your business and have not yet generated revenue.

Equipment financing

If you want to buy equipment to help your business grow, you can take out an equipment loan. Your lender provides you with a lump sum for the equipment, and the equipment serves as collateral for the loan. If you default, your lender can repossess the equipment.

Invoice financing

The invoice financing option is an option for financing a portion of your receivables. Applicants need past invoices and payments from clients as well as outstanding invoices to qualify. Invoice financing companies will evaluate this information and may offer a percentage of the total amount owed. There are varying advance amounts, but you might secure up to 90% of your receivables, which are used as collateral by the financing company. Often, service fees are charged by funding companies.

Invoice factoring

As an alternative to using your invoices as collateral, factoring companies purchase your unpaid invoices from you, allowing you to finance a portion of your unpaid invoices. You will receive an advance of between 80% and 90% of your receivables in exchange. You will receive your remaining amount, minus service fees, after the factoring company collects the full payments.

Microloans

A microloan may be able to help you reach your goals. You might be able to borrow up to $50,000 from a community development financing institution or nonprofit organization with a microloan. Microloans are usually low-interest, and repayment terms are flexible.

SBA loans

Through intermediary lenders, the U.S. Small Business Administration (SBA) also offers microloans up to $50,000. Each lender sets its own requirements for borrowers, but SBA loans typically require collateral and a personal guarantee. There are other SBA loans available, but with limited revenue, qualifying might be harder.

more:Best AI marketing tools for startups I’m using to get ahead in 2025

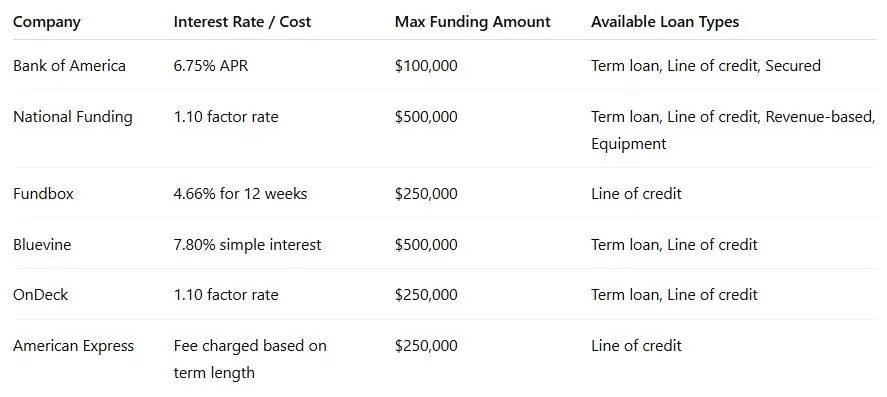

Best business loans for startups with little to no money

How to Get a Startup Business Loan With No Money

You can streamline and simplify the process of applying for financing by following these steps.

1. Evaluate your cash flow and assets

You should review your balance sheet to understand how a new loan might affect the finances of your business when you apply for financing. Lenders will review your cash flow and assets when you apply for financing.

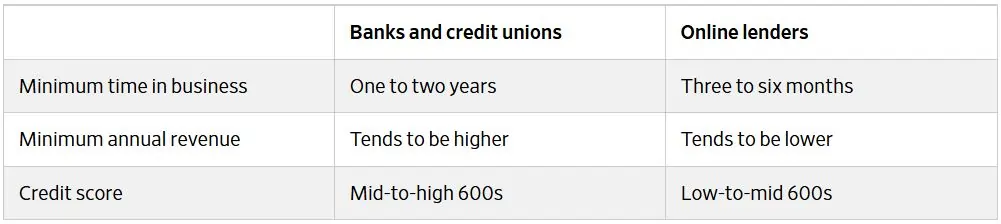

2. Check your eligibility

You can determine whether you qualify for a loan by understanding lender requirements as you narrow down your options for financing. Here are some general criteria you can consider:

3. Prepare necessary documents

If you intend to apply for a loan, lenders will likely require your tax returns, income statements, bank statements, balance sheet, budget, and business plan. Prepare them ahead of time to reduce the amount of time it takes.

4. Determine how much you need and can afford

Estimate what you can afford by determining how much you need to borrow and the amount of payments you will make. Other factors to consider include:

- Debt-to-income (DTI) ratio: Your DTI should be between 36% and 38% based on your monthly debt to income ratio and multiplied by 100. Lenders typically prefer DTIs between 36% and 38% as it indicates that you can manage your debt.

- Debt service coverage ratio (DSCR): You can calculate your DSCR by dividing your net operating income by your total debt service. Lenders prefer a DSCR of 1.25 or higher, which suggests that you have enough operating income to pay off your debts.

5. Compare business lenders and apply

You can find business lenders with a variety of financing options, interest rates, repayment terms, and borrowing amounts. Talk to a few lenders to find the best one for your business. Many lenders accept applications online.

Is getting a startup business loan with no money a good idea?

If you know how you are going to repay the loan, then borrowing the money with limited or no money may be worth it in some cases.

- Getting started: The use of financing can assist you in launching a business, allowing you to access working capital, purchase equipment, and increase inventory.

- Waiting on invoices: Invoices that have not been paid interrupt cash flow, so a loan or accounts receivable financing may provide flexibility while you await payment.

- Growing your business: You can also use a loan to purchase more inventory and equipment, expand your team, or smooth cash flow during the expansion phase of your business.

5 tips for improving your application

If you are applying for a startup business loan, the following steps could increase your chances of approval:

- Add collateral: Your application can be strengthened if you provide an asset, such as equipment or invoices.

- Improve your credit: You are less likely to be turned down for a loan if you have good credit.

- Add a cosigner: Cosign your loan with a trusted family member or business partner who has strong credit.

- Offer a personal guarantee: In the event that your business fails, you must provide a personal guarantee to your lender that you will be liable for repayment.

- Create a solid business plan: Establish a growth path for your business by developing a solid business plan.

Alternatives to getting a small business loan with no revenue

Check out these alternatives if a small business loan doesn’t seem like the best choice:

- Startup grants: There are a wide range of grants that can be obtained from federal, state, and local governments, as well as foundations and corporations. The grants are not repaid.

- Personal loans: There are some lenders that restrict the use of their loans for business purposes. Consider getting a personal loan.

- Small business credit cards: To separate personal and business expenses, you can get a credit card for your small business. However, credit cards usually charge a high interest rate.

- Venture capital: You should create an effective business plan and pitch deck, and then reach out to venture capital firms who invest in businesses like yours.

- Equity financing: Investors can purchase ownership stakes in your company.

- Crowdfunding: If you want to raise awareness about your products and grow your business, you might consider a donation-based or product-based crowdfunding campaign.

Frequently Asked Questions

What is the risk of getting a startup business loan with no money?

It may be difficult for you to repay your loan payments without a solid business plan and a path for growth. This can damage your personal credit if you provide a personal guarantee for the loan.

What is the easiest small business loan to get for startups?

Compare startup loans from banks, credit unions and online lenders, as they all have different requirements for borrowers. Look for alternative financing options like startup grants, crowdfunding, or venture capital, if you need help starting a small business.

Why is cash flow important to business lenders?

A business’s cash flow plays a crucial role in determining the ability of the business to repay its loan. If you apply for funding, a lender will evaluate your cash flow.

Can I get a startup business loan with no collateral?

There are few barriers to getting a startup business loan without collateral, but lenders may require a personal guarantee that the loan will be repaid in the event the business fails.

Do you need to provide a personal guarantee for a business loan with no revenue?

It depends on the lender whether a startup needs a personal guarantee to get a loan.

How hard is it for startups to get small business loans?

Getting small business loans can be tough for startups, especially if you’re brand new and have no revenue to show. A startup’s chances of getting funding depend on its ability to generate a profit and its ability to generate a steady cash flow, both of which are still hard to establish. Nevertheless, you can boost your chances of getting approved by creating a solid business plan, laying out a clear repayment strategy, and offering a personal guarantee.

Can you get a startup business loan with no collateral?

There is no doubt that getting a startup loan without collateral can be challenging, but it is not impossible. In addition to credit scores, business potential, and a well-crafted business plan, there are a variety of unsecured financing options. Think of it as lenders betting on your vision with you. They understand that not everyone can provide tangible collateral, especially in the early stages. In spite of this, unsecured loans can come with higher interest rates and stricter terms. Yet as your business grows, these investments can sometimes give you a boost you need to succeed.

Can you get a startup business loan with no credit?

Getting a startup business loan without a credit history may raise some eyebrows, but it does not mean you can’t start your own business. A credit score is one part of the equation, but it’s not the whole story. Alternative lenders might be more interested in the strength of your business plan, the potential of your market, and your industry knowledge. Basically, you need to paint a picture of your business that says, “I am new to the game, but I have the strategy to succeed.” Keep in mind that these loans may come with higher interest rates or require a more personal approach to ensure you’re a good risk.

Conclusion

In today’s funding landscape, new entrepreneurs who are just getting started have more options than ever before. It is not easy to get a startup business loan without money, no income, or limited credit. There are paths forward for your business even if it is still in its early stages, ranging from equipment financing to microloans to invoice-based funding to alternative lenders.

The key is preparation. Understanding your financial situation, choosing the right type of financing, and presenting a strong business plan will greatly increase your chances of approval. Although your revenue may not be up to where you envision it yet, lenders want you to have an effective growth strategy and repayment plan.

Take the time to compare lenders, evaluate the true cost of borrowing, and determine whether getting a loan at this stage is the right move for your business. If necessary, you may need to seek grants, equity financing, or crowdfunding. A well-structured loan can provide the boost you need to launch, stabilize cash flow, or grow your business.

It’s true that every successful business starts somewhere. With the right approach, the right funding option, and a commitment to your idea, a startup business loan can help make your business a success.